north carolina estate tax return

Income Tax Return for Estates and Trusts. File Pay Taxes.

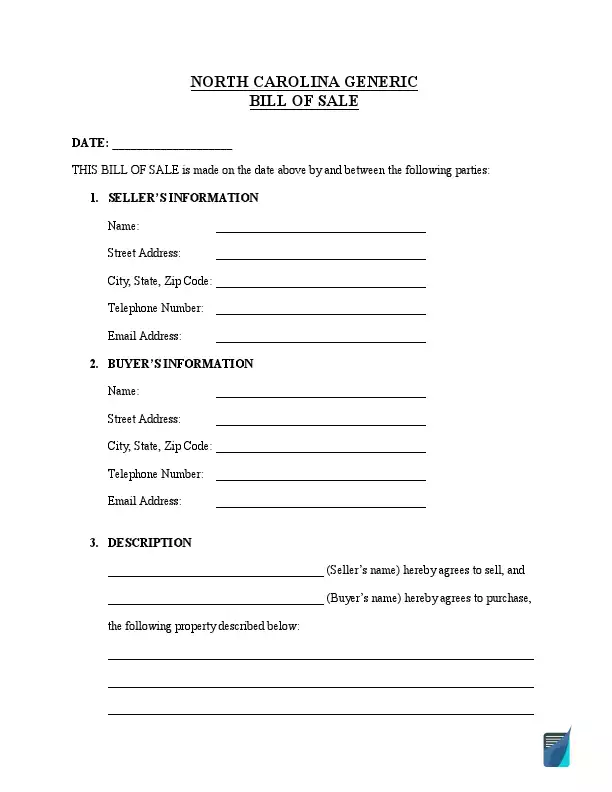

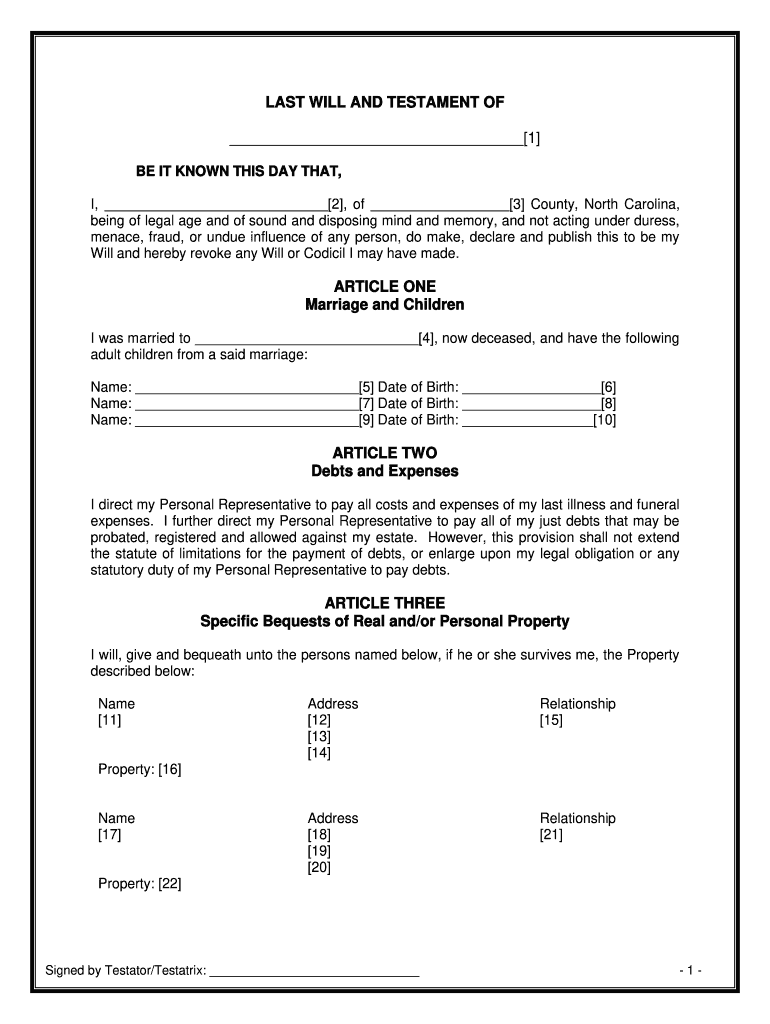

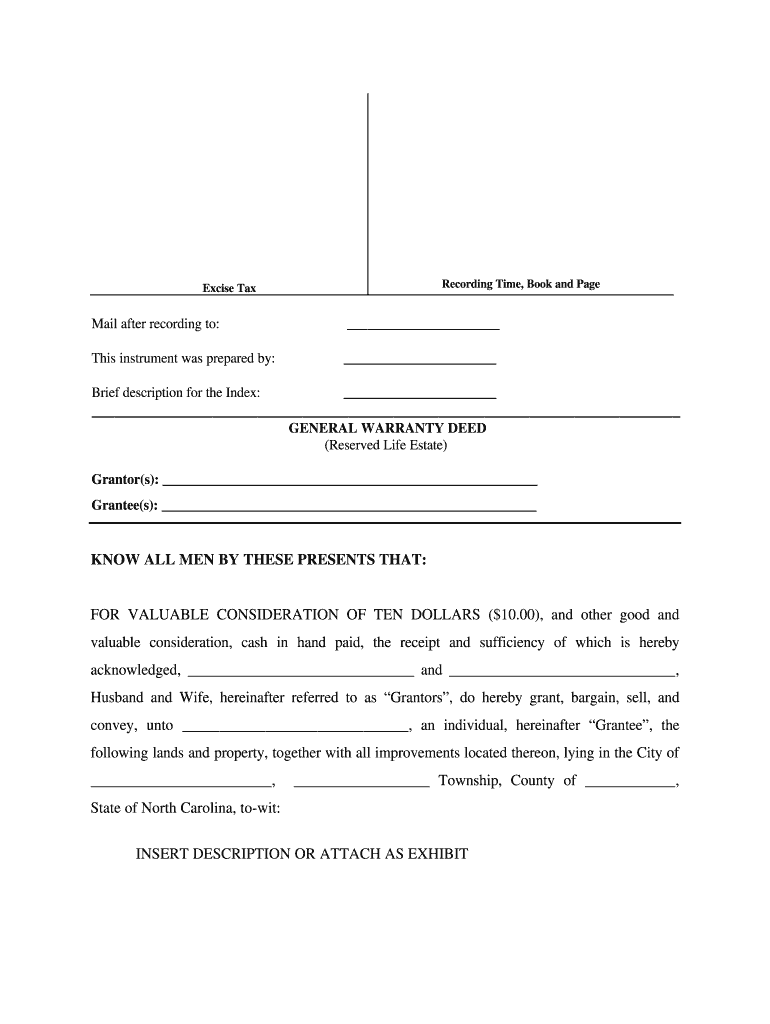

Life Estate Deed Form Fill Out And Sign Printable Pdf Template Signnow

North Carolina Estate Tax Return - 2000.

. The top rate of the federal estate tax is 40 percent at the present time. North Carolina does have income tax but it doesnt have an estate tax or gift tax. North Carolina Department of Transport.

If you are a personal representative and you are filing an income tax return for an unmarried individual or a married filing separately return for a married individual who died during the. PDF 33221 KB - January 04 2021. In North Carolina include a complete copy of Federal Form 706.

Fortunately most people are exempt from the federal estate tax because there is a relatively high credit or. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. Preparation of a state tax return for North Carolina is available for 2995.

Under State law the taxpayer may claim 10000 in real property tax paid. 2021 D-407 Web-Fill Versionpdf. Complete this version using your computer to enter the required.

What Is North Carolina Estate Tax. Work Opportunity Tax Credit. Complete this version using your computer to enter the required information.

1999 Form A-101 North Carolina Estate Tax return Use this form only if death occurred on or after January 1 1999. When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the. North Carolina Department of Revenue.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Due nine months after the individuals death. A fiduciary must file North Carolina Form D-407 for the estate or trust if he is required to file a federal income tax return for estates and trusts and 1 the estate or trust derives income from.

Federal estate tax return. Complete Edit or Print Tax Forms Instantly. Additions and Deductions for Pass-Through Entities Estates.

Ad Access IRS Tax Forms. Federal estatetrust income tax return. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706.

Well work closely with your tax advisor and attorney to prepare your investment plan. If the individual instead had a state income tax expense of 10000 and a real property tax expense. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706.

These should all be considered when you look at the overall state tax structure. Then print and file the form. E-File is available for North Carolina.

Due by April 15 of the year following the individuals death. When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the same time the federal estate tax return is due which is. PO Box 25000 Raleigh NC 27640-0640.

Estates and Trusts Income Tax Instructions. Individual income tax refund inquiries. What Is North Carolina Estate Tax.

2021 D-407 Estates and Trusts Income Tax Return. North Carolina Department of Revenue. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Ask Verified Tax Pros Anything Anytime 247365. However there are 2 important exceptions to this. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same.

Do I Have To Pay Income Tax On My Trust Distributions Carolina Family Estate Planning

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

North Carolina Estate Tax Everything You Need To Know Smartasset

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset

State Employees Credit Union Tax Refund Information

How Do State Estate And Inheritance Taxes Work Tax Policy Center

2018 Sample Tax Returns Agricultural And Resource Economics Nc State University

North Carolina Estate Tax Everything You Need To Know Smartasset

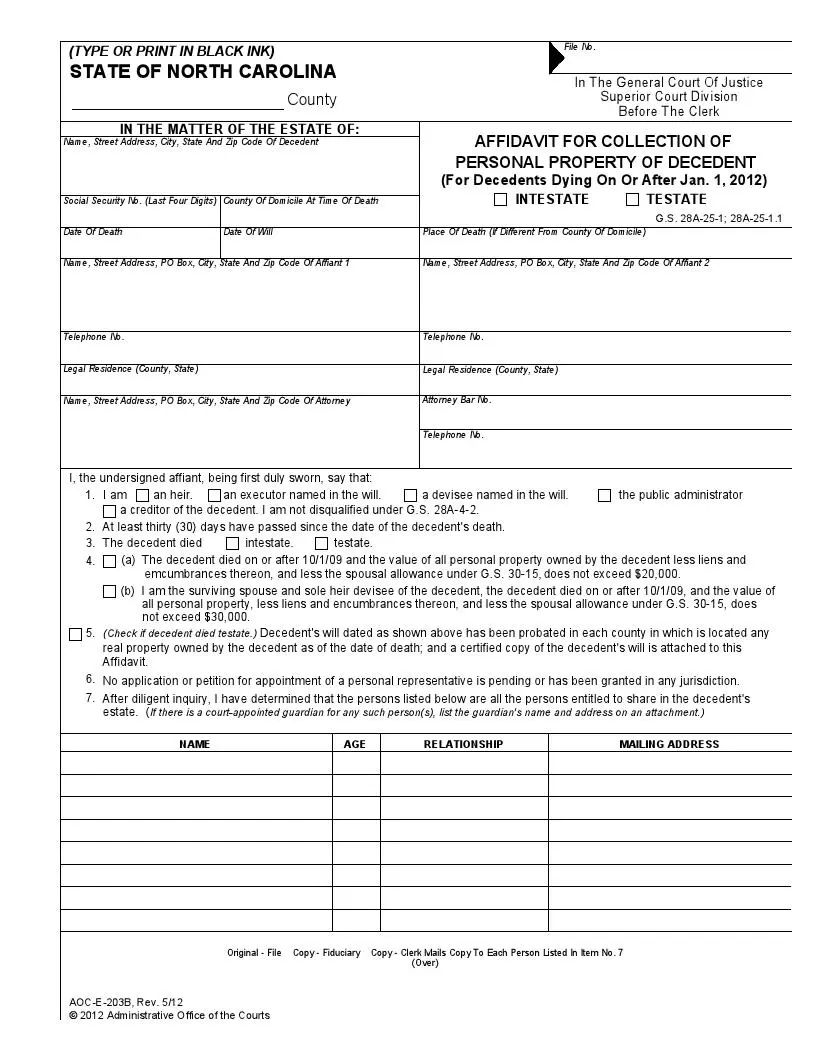

Free North Carolina Small Estate Affidavit Form Pdf Formspal

A Guide To North Carolina Inheritance Laws

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Free North Carolina Small Estate Affidavit Form Pdf Formspal

Tax Free Inheritance Irs Portability Rule Allows Transfer Of Up To 12 06 Million Gobankingrates

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition